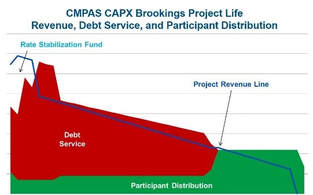

Although most of the “heavy lifting” for the CAPX project is completed, bond covenants require CMPAS to monitor and maintain numberous funds over the 30-year life of the investment. Prior to the distribution of revenue to participants, bond requirements must be satisfied including higher debt principal payments in the first five years. The project’s debt obligation will be completely paid in the year 2041 as represented in the chart below.

Waverly Utilities CEO Darrel Wenzel welcomes the opportunity to work with CMPAS in the future. “The August presentation was a continuation of the transparent process that CMPAS consistently follows. Waverly looks forward to collaborating with CMPAS as transmission opportunities occur in the future,” he said.

Within days of the Agency’s CAPX update, a report, “2017 MISO Transmission Investment Analysis,” validated CMPAS’s assessments of transmission investment benefits. The MCR Performance Solutions report also shows how municipal utility and generation and transmission cooperatives have not invested at a rate consistent with their load ratio share and have not produced enough transmission revenue to offset transmission tariff costs. In fact, only 11 of 31 MISO municipals are investing at a level sufficient to replace annual depreciation.

To prepare for future transmission purchases, CMPAS recommends that municipal utilities educate local commission and city council members about the financial and risk management benefits of transmission ownership. Local leaders should understand the process and necessary commitments so they are ready to participate in and approve CMMPA transmission opportunities when they occur.

RSS Feed

RSS Feed